Google/Compete Study: Digital’s Influence Over the Wireline Service Shopper

Posted:

Wednesday, December 21, 2011

Between my husband and I, we have 14 devices that connect to some type of wireline service. And with a new batch of cool gadgets clamoring for our attention during the holiday season, that number is sure to grow. Not just for us, but for the millions of other consumers lining up to buy TVs, tablets, laptops and so on.

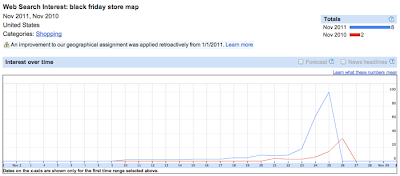

On Black Friday this year, nearly 40% of shoppers purchased electronics and TV purchasers increased by 30%. With all those new, shiny and sleek electronics flooding the market, many consumers are looking to upgrade their current wireline services.

So what good is the piece of hardware without the service provider to deliver the content? And, more importantly to the bottom line of cable TV, high-speed internet and home phone service providers, how are consumers finding the information to make those purchase decisions?

In Google’s new custom research study with Compete, we looked at the surprising and powerful role digital and mobile play in influencing wireline service shopper behavior.

Online presence and Search are the keys to the consumer’s wireline decision process.

The two most-used resources are: provider websites and search engines, in that order. And in terms of most-useful resources, search engines are leading the way, ranking higher than customer service reps and provider websites.

Recommendation: Almost half (49%) of online conversions were directly referred by paid ads, and 50% of all search queries happen on the day of conversion for online purchasers, so maintaining a constant digital presence is vital to reach these in-market consumers.

Customers are looking for the best price, and are willing to wait for it.

We found 20% YoY growth in “deal” queries for wired services. 40% of online purchasers cross-shopped and visited two or more provider websites prior to conversion. And 66% take longer than a week to research the best deal and make a purchase.

Recommendation: Include comparison and “deal” keywords in your mix and keep creative centered around your value proposition. And utilize remarketing to capture consumers who don’t immediately convert on your site.

Mobile researchers are on the rise.

One in 5 wireline service shoppers used a smartphone or a tablet to help them shop, and search is the most popular mobile resource. Not only is the mobile audience growing, but they are potentially a more valuable audience for wireline service providers as they are less price-sensitive and more interested in specific service features than non-mobile shoppers.

Recommendation: Mobile researchers are 20% more likely to purchase via a phone call, so advertisers should use click-to-call ads to make it easy for shoppers to connect with them. And ad creative should focus on features rather than price for this more-sophisticated audience.

Don’t sleep on “generic” queries.

An average of 18% of search queries made at every stage in the purchase cycle were non-brand queries. Even on the day of conversion, almost 1 in 5 search queries is not attached to a brand or service provider.

Recommendation: Advertisers should maintain a consistent presence on non-branded and generic terms to capture all in-market shoppers.

For more information, you can download the full study here.

Posted by Kristin Sutter, The Google Technology Team

On Black Friday this year, nearly 40% of shoppers purchased electronics and TV purchasers increased by 30%. With all those new, shiny and sleek electronics flooding the market, many consumers are looking to upgrade their current wireline services.

So what good is the piece of hardware without the service provider to deliver the content? And, more importantly to the bottom line of cable TV, high-speed internet and home phone service providers, how are consumers finding the information to make those purchase decisions?

In Google’s new custom research study with Compete, we looked at the surprising and powerful role digital and mobile play in influencing wireline service shopper behavior.

Online presence and Search are the keys to the consumer’s wireline decision process.

The two most-used resources are: provider websites and search engines, in that order. And in terms of most-useful resources, search engines are leading the way, ranking higher than customer service reps and provider websites.

Recommendation: Almost half (49%) of online conversions were directly referred by paid ads, and 50% of all search queries happen on the day of conversion for online purchasers, so maintaining a constant digital presence is vital to reach these in-market consumers.

Customers are looking for the best price, and are willing to wait for it.

We found 20% YoY growth in “deal” queries for wired services. 40% of online purchasers cross-shopped and visited two or more provider websites prior to conversion. And 66% take longer than a week to research the best deal and make a purchase.

Recommendation: Include comparison and “deal” keywords in your mix and keep creative centered around your value proposition. And utilize remarketing to capture consumers who don’t immediately convert on your site.

Mobile researchers are on the rise.

One in 5 wireline service shoppers used a smartphone or a tablet to help them shop, and search is the most popular mobile resource. Not only is the mobile audience growing, but they are potentially a more valuable audience for wireline service providers as they are less price-sensitive and more interested in specific service features than non-mobile shoppers.

Recommendation: Mobile researchers are 20% more likely to purchase via a phone call, so advertisers should use click-to-call ads to make it easy for shoppers to connect with them. And ad creative should focus on features rather than price for this more-sophisticated audience.

Don’t sleep on “generic” queries.

An average of 18% of search queries made at every stage in the purchase cycle were non-brand queries. Even on the day of conversion, almost 1 in 5 search queries is not attached to a brand or service provider.

Recommendation: Advertisers should maintain a consistent presence on non-branded and generic terms to capture all in-market shoppers.

For more information, you can download the full study here.

Posted by Kristin Sutter, The Google Technology Team